ADP’s employee retirement plans integrate with the company’s popular payroll software, automating data entry and flagging any potential mistakes. This saves small business owners and their HR staff countless hours by eliminating the need to manually enter payroll and retirement information. When we researched retirement plan providers, we found in our review of Paychex that it was the only other vendor to offer a native integration with its payroll service. By keeping everything in one unified system, business owners can streamline and improve their HR operations. It’s clear that ADP had all small businesses, from sole proprietors to 100-person organizations, in mind when developing its employee retirement plans. This plan sponsor understands that small businesses are unique and want retirement programs that meet their specific needs.

- For Legacy versions

of Enhanced Time v7.0 and lower, Chrome is not a supported browser. - Our research also revealed how safe and straightforward ADP makes it to upload and store the documents that are necessary to establish your retirement plan.

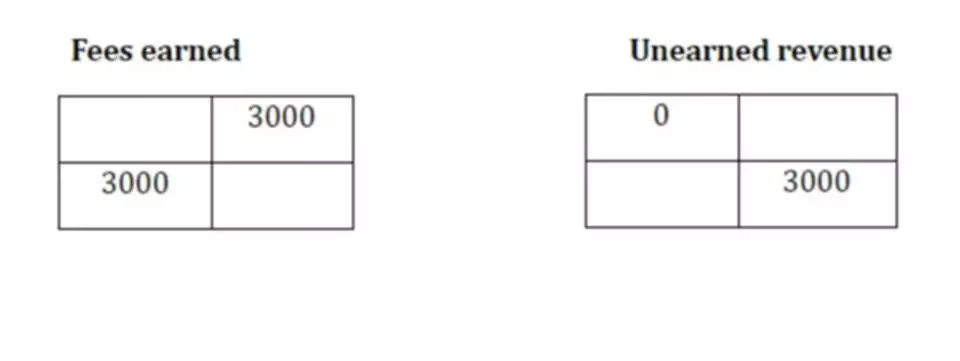

- The company’s Retirement Readiness calculator, for example, estimates how much money they’ll need for retirement based on their lifestyle goals and how well they are tracking toward those goals.

- ADP’s payroll system integrates with the company’s employee retirement plans by connecting your data sets through the vendor’s SMARTSync tool.

- ADP offers a variety of plans for every size business that may be interested in not just 401(k) plans but also SIMPLE IRAs and SEP IRAs.

Additionally, the ADP website has a resource center, including sections specifically for small businesses; answers to frequently asked questions; a blog; and webinars. We appreciate that ADP makes it simple for employees to plan for retirement and track their financial goals. The company’s Retirement Readiness calculator, for example, estimates how much money they’ll need for retirement based on their lifestyle goals and how well they are tracking toward those goals.

What type of employee retirement plans does ADP offer?

Small business owners will also appreciate the company’s mobile app, which makes accessing plan information particularly easy for both employers and their employees. Small business owners don’t have excessive amounts of time to shop around for a retirement plan sponsor that meets their needs. They may find it easier — and safer — to go with a well-known brand like ADP that can offer a variety of plans and valuable features that can be customized.

ADP offers many types of employee retirement plans, including traditional 401(k), individual or solo 401(k), SIMPLE IRA, safe harbor 401(k) and Roth 401(k). Another potential downside is the poor customer reviews on the BBB website, which notes that ADP has closed nearly 900 complaints in the past three years. Going it alone could be better than dealing with subpar or inconsistent customer support. Among the other reasons ADP is the best retirement plan vendor for small businesses is the company’s customer service. Business owners have access to a dedicated account manager who can assist during implementation and beyond.

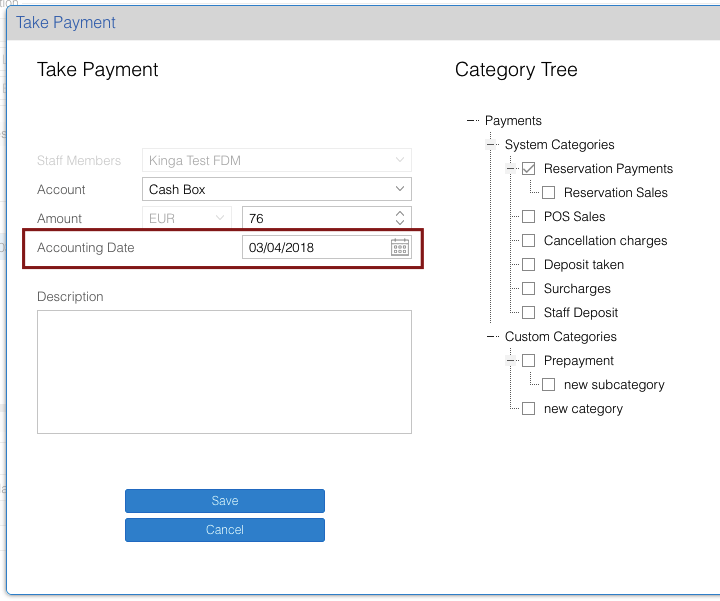

If you’re a business owner rolling over an existing retirement plan, the Document tab in the ADP portal clearly outlines what forms you need to fill out. The Communication tab lets you know if your employees have been notified of the plan, while the Activate tab tells you when your HR staff will be trained on the plan and when payroll is set up. We like that the dashboard also includes target dates to keep you on track with your plan implementation. Another great feature is that once the system is launched, employees can enroll on demand and employers can send a text to each staffer for text-to-enroll capabilities that encourage participation. ADP empowers you and your HR leaders with access to useful technology and tools that help you get your business’s retirement plan up and running. The vendor also has a team of dedicated managers to help with implementation.

Sign in to ADP®

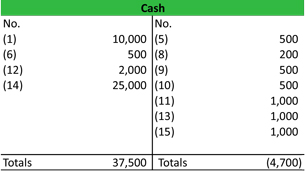

When you partner with ADP, you can choose from a traditional 401(k), an individual or solo 401(k), a SIMPLE IRA, a safe harbor 401(k) and a Roth 401(k). Adding to the company’s appeal, ADP’s retirement plans integrate with its highly rated payroll services. ADP’s payroll system integrates with the company’s employee retirement plans by connecting your data sets through the vendor’s SMARTSync tool. This eliminates the need for manual data entry, automatically flags potential errors and saves small business owners valuable time by streamlining recordkeeping.

Features and Services

Small business owners aren’t experts at creating retirement savings plans; many need the help of a reputable plan provider. Furthermore, small businesses need the same access to investment advice and research as larger enterprises. For these reasons, ADP stood out to us as the best solution for small businesses. ADP handles regulatory compliance, including trustee services, ERISA bond, and Form 5500 completion and filing.

We like how ADP provides advisory services to reduce the risk small businesses face when selecting investments for their retirement plans. For ADP’s plans that work with an adviser, third-party company Mesirow offers co-fiduciary or investment management services. Otherwise, ADP Strategic Plan Services provides fiduciary and investment services. Take the time to call ADP to get a specific quote if you are seriously adp freedom considering the vendor for your retirement plan. Yes, it’s an extra step, but it’s the only way you’ll know precisely what the plan will cost you and your employees so you can accurately compare the costs with those of competing plan providers. With ADP’s SMARTSync tool, you can integrate your retirement plan data with ADP’s payroll software, thus eliminating manual entry and reducing potential errors.

ADP 401k Review

ADP makes it easy to establish a retirement plan for your business, especially with a team of implementation managers at your disposal. The company even has English and Spanish language assistance, which opens up the program to more business owners. With the help of this support staff, your business’s plan can be established the very same day you ink a deal with ADP.

Mobile App

It’s a fairly effortless way for workers to stay engaged in their financial planning and contribute to their future success. Additionally, ADP TotalSource is a comprehensive PEO with bundled HR features. For ADP Workforce Now Enhanced

Time & Attendance® (formerly known as Enterprise eTIME) clients, Chrome

is a supported browser for Enhanced Time v8.0 only. For Legacy versions

of Enhanced Time v7.0 and lower, Chrome is not a supported browser.

How-to videos and links to more help embedded in the company’s dashboard are other features we like. Most small business owners aren’t retirement plan experts; they need fast access to assistance and comprehensive information at their fingertips. In addition to an easy-to-use dashboard and its built-in resources, ADP gives small business owners access to a dedicated account manager to make sure everything runs smoothly for your organization. If you want a retirement plan that’s easy to implement and manage — with a digital dashboard, a mobile app and access to dedicated support — ADP is the ideal solution for your small business.

After all, a sole proprietor won’t want the same plan as a business with 100 employees. Thanks to its many attractive plan options, ranging from a traditional 401(k) to a SIMPLE IRA, ADP is capable of satisfying https://adprun.net/ all types of small (and large) businesses. If you’re already using ADP for payroll or other HR services, you may be entitled to special pricing for adding employee retirement plans to your package.