Cash flow can quickly go in the wrong direction if you’re pricing your services poorly. If you don’t have enough profit to generate the working capital needed to pay for supplies, payroll, and bills, for instance, trouble is not far off. Bank study, 82 percent of business failures are due to poor cash management. Small Businesses owners and CEOs need to make decisions that sometimes can cause negative long term results with their business’ cash flow.

‘You don’t need savings’: Grant Cardone blasts Dave Ramsey’s ‘save your money’ tips — says ‘real estate is a much safer investment.’ A head-to-head look at their polar money advice – Yahoo Finance

‘You don’t need savings’: Grant Cardone blasts Dave Ramsey’s ‘save your money’ tips — says ‘real estate is a much safer investment.’ A head-to-head look at their polar money advice.

Posted: Wed, 16 Aug 2023 15:35:00 GMT [source]

For example, a hair salon owner might adopt procedures like sanitizing hourly, offering virtual consultations, and delivering colour kits to keep their doors open and cash flowing. The end of the fiscal year can be highly stressful for financial officers and corporate executives. The year-end closing procedure is time-consuming and sometimes brings unpleasant surprises. Particularly in times of economic downturn and short staffing, year-end… For any requests about our product and solutions, call us or fill in the contact form and our teams will contact you.

Ways To Resolve Your Cash Flow Problems

For example, say you land a large client contract that is beyond your company’s current capabilities. In order to fulfill this request, you need an extra four members of staff to deliver the project on time. When you open the doors Cash flow problems to your business, you probably hope that customers will be lining up waiting to purchase from you. According to CB Insights, 38 percent of startups fail because they ran out of money and were unable to raise more capital.

You should dig beyond their financial ratings and look into whether their strategy and culture are in line with your own. You can also consider whether they have risk coverage and cash flow protection, like trade credit insurance. This usually indicates strong corporate governance, the ability to take smart risks and an avenue to manage potential exposure. Note that a cash flow problem is not necessarily the same as experiencing a cash outflow. A business often experiences a net cash outflow, for example when making a large payment for raw materials, new equipment or where there is a seasonal drop in demand. If a customer doesn’t want to pay you in cash, then be sure to conduct a credit check—especially before you sign them up.

Key cash flow management techniques

Finally, if your customers are facing cash flow issues of their own, negotiating with them to find mutually beneficial solutions may be necessary. According to QuickBooks, almost two-thirds of small business owners regularly struggle with cash flow issues. Creating regular cash flow forecasts, applying for financing, monitoring expenses, and adapting your pricing and sales strategies are all valuable long-term solutions to address cash shortages. Finally, one of the best ways to prevent or cope with cash flow problems is to build a cash reserve that can cover your expenses for at least three to six months. A cash reserve can help you weather any unexpected events or emergencies that could disrupt your cash flow, such as a pandemic, a natural disaster, a lawsuit, or a loss of a major customer. You can do this by setting aside a percentage of your income each month or quarter into a separate account and saving any extra cash from windfalls, such as tax refunds, bonuses, or grants.

Your first step should be to know exactly what you’re spending and where you’re spending it. Categorize your expenses into G&A, R&D, Sales & Marketing, Operations, and COGS, and see if anything stands out. Note the percentage spends for each category, and analyze whether the cash distribution makes sense. However, regardless of your lifecycle stage, industry, or plans for growth, your expenses should never exceed your existing cash. Having too little on hand could hamper you from selling as much as you could, but having too much carries its own problems. All that money tied up in inventory is money that isn’t working for you, so consider discounting your older or slower-selling products to give yourself some operating capital.

Cash flow problems – common issues for international businesses

Whatever actions you pursue, ideally, you’ll want to have sufficient reserves to cover roughly six months’ worth of expenses. You might experience a market downturn, production hiccups, seasonal sales, labor shortage, or any challenge temporarily limiting your income. Unless you have a prediction engine worthy of being in a sci-fi novel, you likely will have little — if any — advance notice before these problems hit. If you spend time monitoring business trends — collectively or within your organization — you’ll quickly notice that operations tend to be cyclical. Rarely do you find an industry, market, or corporation that performs on a steady, predictable basis; the most consistent element of any business trend is its inconsistency.

- Particularly in times of economic downturn and short staffing, year-end…

- I invoice my client at the beginning of each month after the work has been done.

- Customer payment periods of 30, 60 or 90 days are becoming more common for small to mid-sized businesses as inflation rises.

- You can then make arrangements for additional borrowing, for example.

- Having this information handy can give you an accurate cash flow projection under normal circumstances.

And in many cases, it’s a combination of both controllable internal challenges and unavoidable external ones that can work against your sales goals. While that growth is great for your bottom line, you may also face some growing pains along the way, with cash flow being just one of them. More than 30% of SMBs are negatively impacted and spend an average of 15 days each year chasing payments alone. As entrepreneurs, we all have a fear of running out of money and having cash flow problems. The absence of a “predictable paycheck” is scary, but the rewards of owning your own business far outweigh those risks. There’s a variety of mobile payment apps that leverage the power of your smartphone or tablet to accept a client’s invoice payment by credit and debit card.

What Are the 3 Types of Cash Flow?

In their study, they found that 82% of the time, poor cash flow management or poor understanding of cash flow contributes to the failure of a small business. You will have to pay eventually, of course, but one way to hold on to more cash when you’re in a bind is to spend it more slowly. Don’t jeopardize your relationships, but depending on the specifics of your situation, it might make sense to take a small interest rate penalty if you can make better use of the cash right now. There are companies that will buy your outstanding invoices for cash on the spot. Only consider selling your receivables if you’re struggling with a temporary problem that has a clear end in sight.

Although borrowing money can seem like a tempting lifeline during a cash flow crisis, there are some caveats. First, you’ll need to have a documented business plan and cash flow forecast to show lenders. Second, interest rates and other terms and conditions can have long-lasting consequences. Finally, if there’s an internal flaw in your business, a fresh injection of cash won’t solve cash flow problems. We know that the majority of small businesses fail within the first five years, but a recent study by U.S.

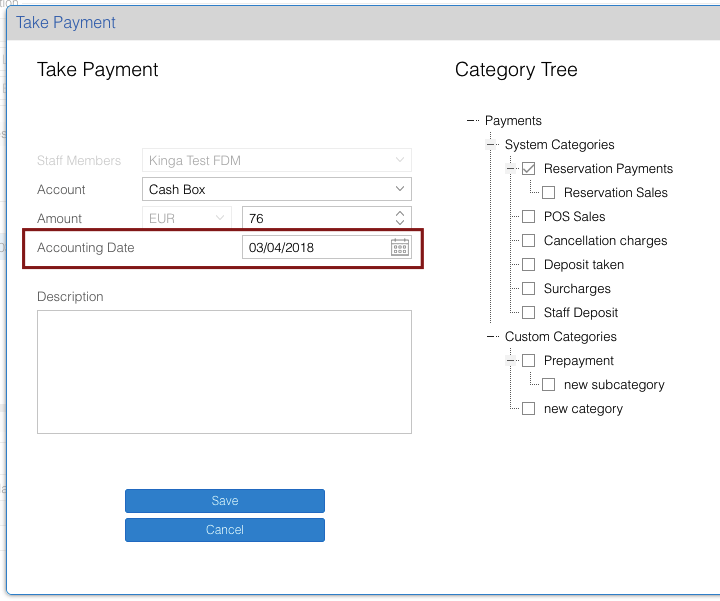

Once you establish a customer base, make sure you receive payments on time. Late payments affect the cash cycle and may cause companies to find themselves unable to pay their own bills from vendors and suppliers. To reduce cash flow problems, follow up with late customers on a timely basis, and enforce the late payment terms written into contracts. Auto-invoicing and auto-billing can also be beneficial in helping business owners receive payments. Automatic invoicing refers to the use of accounting software that sends invoices for you.

This can work but it’s really just a band aid and unless you have exceptional interest rates, the fees can add up. Bank loans are also effective but they require long wait times during the application process and you need the cash quickly. Profit shortfalls will also eat away at cash reserves and these low periods may forecast a much larger problem. When the business is so far behind that daily cash flow is being reallocated to cover other costs, it’s time to consider restructuring, re-branding and pivoting to get back on track. While a surge in business can lead to cash flow issues, other more worrisome problems can also arise.

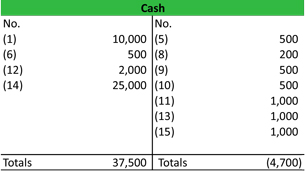

The money is available when needed but using the line of credit is also not mandatory. The cash flow statement is used to map and plan when, and how much, cash will come in and out of a business. This financial statement evaluates the business’ current cash position and also helps forecast upcoming cash transactions. One way to do this is to carefully manage assets and liabilities. For example, not following up on tardy payments in accounts receivables will delay and decrease the amount of cash coming in. Not filing the necessary documents like preliminary notices to protect your lien rights can also wreak havoc on your liquidity.

What Does an Income Statement Represent & What Period of Time Does it Cover?

Depending on your business model, it’s possible that when you raise prices, you’ll make more money doing less work. If your business collects payment through invoices, stay on top of them. The money won’t come in until the invoices go out, so don’t put it off.

RTX shares tumble on Pratt & Whitney airliner engine problem – Reuters

RTX shares tumble on Pratt & Whitney airliner engine problem.

Posted: Tue, 25 Jul 2023 07:00:00 GMT [source]

Industry or regulatory standards may also play a role in determining a minimum cash reserve. Determining how cash flow problems lead to business failures can save business owners from making costly mistakes. Just as importantly, knowing the effects of cash flow problems can help prevent them. Another consideration that might help business owners is assessing the credit worthiness of the customers that you do business with. By doing this you may be able to better understand their ability to pay you.