• Adoption of advanced technologies that helps in identifying and reacting to the threats before they occur is anticipated to fuel the growth of the market. This proactive approach to security uses big data analytics and automation to detect security events more precisely. Together these technologies detect weak signals and predict risks by rapidly analyzing massive amounts of data – so you can react to suspicious behaviors immediately. Documenting prescriptive security in banking this process can act as a guidebook to your cybersecurity program, and it can provide a platform for replacement cybersecurity analysts and leaders to review and be brought up to speed on your capabilities and position. According to the case study, the client bank found that their current fraud detection process for the online application of their main application processing system had been rejecting over half of the applicants.

But asking good questions and getting to the source of the problem requires tapping into our education and training, unique experiences, and skill sets. A great cybersecurity professional will start along a path and have the ability to dynamically adapt questions to eliminate issues and get closer to troubleshooting the ultimate issue. During stress, mistakes can happen and important processes can be overlooked and forgotten. The software can detect these inconsistencies after being trained, and so it will be more sensitive to those data points within transactions and flag them if the location data and the purchased product is suspicious.

Cybersecurity Email Bulletin

This does not only contribute to the profitability of the organization, but also helps in improving customer relationships, opening better opportunities in the future. Banks are using predictive and prescriptive analytics, not only in financial management applications, but also in ensuring better planning for liquidity or availability of cash. As optimal management of liquid assets through business intelligence can lead to more profitable outcomes, predictive and prescriptive analytics tools are likely to gain more popularity in the finance sector.

- We can infer from this quote that not every member of a working data science team may necessarily need a high-level academic background in AI.

- As the tools used by banks and other financial service providers have become more innovative, so too have those deployed by criminals and bad actors seeking to exploit the new digital landscape.

- The Prescriptive security market can be segmented on the basis of application, and deployment mode and industry vertical type.

- For example, crowdfunding website Patreon uses Stripe to process their payments, which a bank using predictive analytics software could recognize as a separate entity.

- Prescriptive technology helps in identifying and reacting to threats before they occur.

- Asia Pacific is expected to have the fastest growth in the market due to mobile workforce expansion, promoted by the increase adoption of mobile gadgets.

In many cases, banks can overcome these obstacles by managing the transition to advanced analytics as part of a structured process. One example of such a process – in this case, a process comprising four phases – is illustrated in Exhibit 2. Each of the four phases is executed through the performance of specific tasks, which in turn produce defined outputs and ultimately lead to improved predictive analytics capabilities. As their analytics maturity levels increase, banks can expect to achieve even greater value from their investment in data. Many have already achieved some of the benefits of analytics maturity, such as operational cost reductions and the modernization of business intelligence and data warehousing.

Taking a more proactive approach to security

One of the most common barriers to Docker adoption for production deployments is a misconception around data persistence, or lack thereof. While it is true that if you remove a Docker container it’s destroyed and the data is lost but that doesn’t have to be the case. One of the biggest problems for businesses today is an absence of or gaps in business continuity. Business continuity allows business to continue operating during and after a disaster. Still there are chances of not getting the desired outputs given the complexities involved at each step. Apart from these challenges, it is also a main challenge to define the problem statement clearly before initiating analytics roadmap.

Read more to find important insights on how the future will unfold for the banking sector through a wide range of applications of tools integrated with predictive and prescriptive analytics. Through the use of advanced predictive and prescriptive analytics, banks are applying technology in ways that can have a direct and tangible impact on their ability to access and apply useful business intelligence capabilities. Regulatory requirements in highly regulated industries, such as financial services, often force the creation of strong risk appetite frameworks. Banks are getting more sophisticated with the system they follow to evaluate load applications.

Top Applications of Predictive and Prescriptive Analytics in Banking and Finance Sector

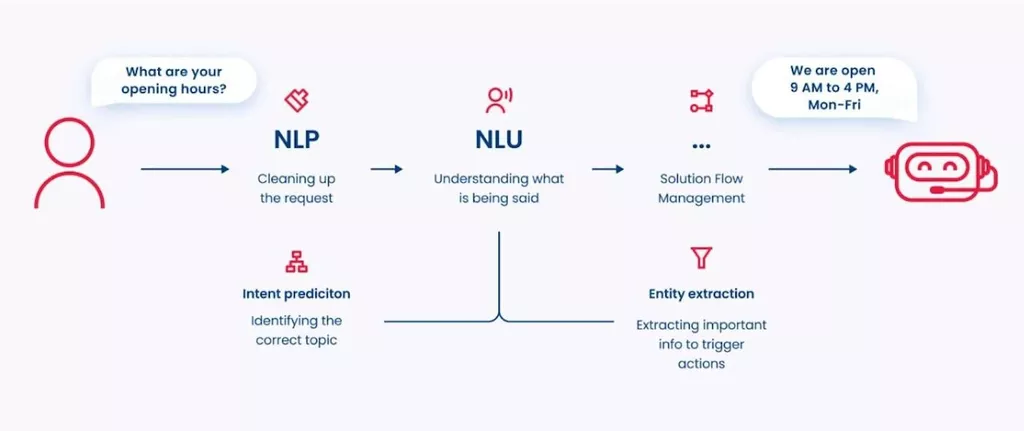

Identifying opportunities for using automation to apply controls in line with the risk appetite and to measure the degree of overall alignment with it will ensure a more sustainable environment for risk management. The technology risk and cyber risk taxonomies should encompass all current and emerging technology risks and cyber risks. Organizations commonly structure taxonomies according to the possibility that different impacts of technology risk or cyber risk will be realized. For example, the tech and cyber taxonomy may be structured by availability loss of systems, confidentiality compromise, data integrity compromise, project management risks, or any combination of those possibilities. Prescriptive Security is vital for financial institutions for addressing the increased security complexity in the digital age. Its big data and automation are critical for the new generation of security operations.

No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. KPMG has market-leading alliances with many of the world’s leading software and services vendors. Patch Management

Hackers have been known to take advantage of vulnerabilities in operating systems and third-party applications that were not kept up to date. Keeping current with the latest software updates and firmware patches helps reduce a system’s attack surface significantly.

Combining AI with a trusted data approach on IBM Power to fuel business outcomes

Feedzai claims to have helped one of the top retail banks in the US more accurately detect fraud. They published a case study showing that bank’s success with the software, but did not mention them by name. This is important to watch out for when considering AI software vendors, but because of Feedzai’s team of AI talent and marquee clients such as Citibank we are confident that they do actually use AI. The software can then notify a human monitor of any deviations from the normal pattern so that they may review it. The monitor can accept or reject this alert, which signals to the machine learning model that its determination of fraud from a transaction, application, or customer information is correct or not. • Rules and regulation imposed by the government mandating prescriptive standards for all market players is anticipated to restrict the growth of the market.

Analysts’ rankings that consider security maturity may be affected; in turn, affecting the refinancing condition of a bank and the cost of risk for insurers. Moving beyond predictive security into the world of prescriptive security is an exciting development that none can afford to miss. Device Hardening Protocols

While changing https://www.globalcloudteam.com/ factory-set passwords might seem like a simple action, many institutions struggle with it. But it is also because, during the installation process, many skip this step, assuming they’ll come back to it later. Unfortunately, just one camera that still has the default password can increase a network’s vulnerability to attacks.

Smart decisions. Lasting value.

This is nowhere clearer than in the security domain, where the fusion of big data, advanced analytics and machine learning promises to deliver startling improvements in cyber security through the introduction of Prescriptive Security. Working with a Trusted Supply Chain

Banking and financial institutions need to work with vendors who manufacture all aspects of their cameras or security system products and who control their own distribution. End-to-end, in-house manufacturing is the best way to ensure that parts and chipsets are built following best practices.

Identifying security risks – and sometimes even knowing when cyber-attacks are underway – presents financial service providers big and small with huge challenges. These challenges have become more acute as banks have transitioned more of their operations onto digital platforms, presenting more opportunities for cyber-attackers. The task facing banks, as they manage this digital transition, is ensuring that the tools they deploy to detect and neutralize cyber-attacks keep up with the pace of technological change and innovation. A crucial way to achieve this is by using prescriptive security technology, which can scrutinize large amounts of data to identify key indicators that might suggest a cyber-attack is taking place. Banks can use predictive analytics-based fraud detection software to detect fraud across multiple channels involved in payment processing.

Ways How Future for Banking is Predictive and Prescriptive

Industry verticals served by the prescriptive security, are law enforcement and intelligent agencies, public transport security, critical infrastructure security and border control. As there are numerous security problems detected in the organizations owing to the potential security incidents, industries and vendors are opting for the more advanced analytical capabilities. The client bank deployed Feedzai’s fraud detection software within their application processing system using their own databases.